Great sums of money can circulate through a HOA. Dues and HOA assessments come in while expenses for maintenance, repairs, and improvements flow outward. By using careful accounting procedures and providing regular financial statements, you can demonstrate that the HOA’s money is being handled appropriately, which is important for future planning and accountability of its members.

Here is what your HOA financial statements should include.

Aged Delinquency Report

This report details the association’s income and is especially unique and important for HOA and community associations as it breaks down which homeowners are behind in paying assessments, late fees, and dues. Depending on how detailed your report is, you may be able to pinpoint the areas in which the homeowners are delinquent.

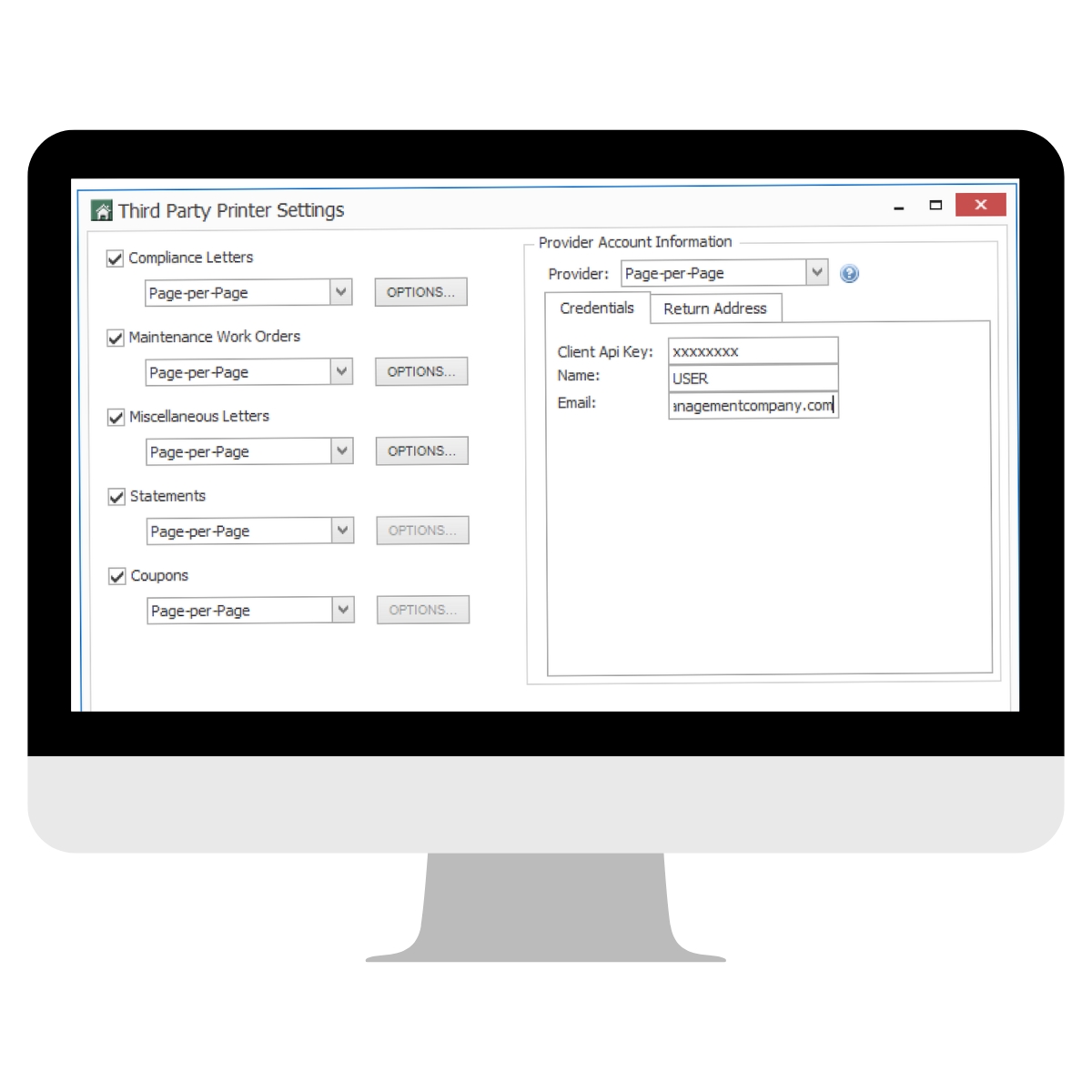

In circumstances where your board must quickly collect payment, you may consider utilizing the help of professionals who are experts in community management mailings like Page Per Page. They offer the ability to quickly design, print and mail reminders and late notices so you can focus your time solely on managing the cash flow.

Why is it important?

This Aged Delinquency Report is particularly vital for associations because dues and assessments represent the cash flow for HOA and community associations. Without them, it cannot run effectively, which is why it’s imperative to resolve delinquencies quickly.

Balance Sheet

Another important part of a HOA financial statement is the balance sheet, as it tells where assets, liability, and reserves stand.

Key accounts that HOA and Community Associations should focus on include:

- Cash in the Operating Checking Account – The ability to meet current expenses

- Accounts Payable – Shows what is owed from the checking account balance to contractors, vendors, and service providers

- Capital in Reserve – Details the amount available for major capital repairs and replacement projects in the future.

Why is it important?

This balance sheet allows the board to know how well they can meet their immediate financial obligations and measure their progress toward future goals.

Statement of Revenue and Expense

In addition to the aged delinquency report and balance sheet, the statement of revenue and expenses compares the association’s activities with those outlined in the budget. At a glance, this report compares actual expenses versus the budgeted expenses.

Why is it important?

If the actual expenses differ significantly from the budgeted ones — for example, if there were a heavier snowfall than anticipated making extra snow removal necessary — adjustments can be made or special assessment can be levied to cover the extra expense.

Bank Reconciliation

The bank reconciliation report is proof that the cash assets from the balance sheet match the bank statements. It takes into account outstanding checks and deposits that may not have been processed by the bank. It also doesn’t appear on the most recent bank statement and enables the reader to see all transactions at a glance.

Why is it important?

When every transaction is detailed, there is less room for error. Missing checks or discrepancies in deposit amounts can be red-flags that signal potential problems, like theft or carelessness. This document will signal that something is wrong. With it, you can catch errors quickly and efficiently.

Page Per Page Can Help

Accurate HOA financial statements help to identify what’s working within your organization and problematic areas, like members who are late on dues or assessments. Acquiring revenue owed is crucial to the overall financial health of your HOA, which is why sending reminders and notices is important.

Creating and mailing financial reminders and notices can be a time-consuming task that can easily be alleviated by delegating it to the professionals at Page Per Page.

Page Per Page is a family-owned and managed print, mail, and HOA technology solutions company that specializes in the community association industry. With decades of experience, the team at Page Per Page has the design, print, and mailing expertise any HOA needs to be successful in their operations.

Want to start offloading some of those tedious printing and mailing responsibilities?