Homeowners associations account for 60% of newly built homes and 80% of homes within a subdivision. That’s why it’s critical, whether you’re a new homeowner or a longtime HOA member, to understand the ins and outs of HOA fees (also known as HOA dues).

What Are HOA Fees?

HOA fees are an amount of money that the homeowner pays to their HOA board on a monthly or quarterly basis. The board then uses these fees to maintain the neighborhood and its amenities. If your neighborhood has an association, then HOA fees are typically mandatory, not voluntary. The best way to think about it is: your HOA is like a small government, your HOA dues are like taxes, and your board members are like the elected officials who decide how those taxes are spent.

How Can a Board Utilize HOA fees?

Many key functions of an HOA are supported by HOA fees, including:

- Common area maintenance: Spaces that are under the HOA’s jurisdiction must be maintained, such as front or shared lawns as well as mailboxes, sidewalks, parks, and streets. For example, the board may hire a landscape company to mow the grass in common areas or provide snow removal.

- Community amenities: Neighborhoods that have common amenities such as a pool or clubhouse may endure higher HOA fees to cover expenses like water, electricity, employees, etc.

- Trash removal: HOAs will sometimes create a community-wide trash service to make sure the entirety of the neighborhood is maintained to the same standard.

- Property insurance: Many HOAs establish an insurance policy to protect common grounds within the neighborhood. For example, in a condominium or townhouse, the property insurance will protect the external land as well as the exterior of the building(s). Homeowner Note: this is different from homeowners insurance, which covers anything within your property in the case of damage or theft.

How Do Board Members Set HOA Fees?

The amount of an HOA fee is dependent on the amenities provided by the community. The expenses of all efforts are then divided equally among the homeowners. The more services provided, the higher the cost. For example, if you are part of an HOA with a community pool, your HOA dues will reflect expenses associated with it.

What Are Average HOA Fees?

Research shows that the average cost of HOA fees is more than $300 per month. However, in New York, for example, or other states in which living expenses are generally much higher, HOA fees average around $570 per month.

Added Costs

Keep in mind that HOA dues are not necessarily fixed. So, depending on the needs of the community, they can decrease and increase year over year. Some HOAs are more proactive about homeowner communication, and will inform them on when and why their dues will be increasing, while others keep homeowners in the dark. This contributes to the negative reputation that clouds many HOAs.

Additional expenses are usually the product of unforeseen circumstances, such as drainage problems causing a water backup in the neighborhood. In this case, board members would likely determine how payment for the repairs will be remitted. Ideally, this would come from the reserve fund that was already worked into the budget.

Homeowner note: While a reserve fund may increase the HOA fee, it would also alleviate you from paying a last minute assessment as a result of an emergency.

If there is no reserve fund, board members will need to vote to determine if homeowners will need to pay an assessment to cover the cost. Often, homeowners are not included in the vote but sometimes have the opportunity to veto the decision (these requirements are also determined by state laws). It’s worth noting that a majority approval is needed to reject a special assessment/fee.

What Happens If You Don’t Pay HOA Fees?

When purchasing a home that’s in an HOA, homeowners are required to sign documents agreeing to abide by the covenants and restrictions set by the HOA. This is legally binding, meaning that if you do not pay HOA dues the board can take any of the following steps:

- Send demand letters or use a collection agency to get the past due funds.

- File a civil suit to obtain a personal judgment against the homeowner.

- Initiate steps to put a lien on the property and possibly force foreclosure.

With that said, if you cannot pay HOA fees due to financial hardship, like the loss of a job, you can discuss the issue with the board. The board must then decide whether to grant leniency and provide more time. More often than not, it’s in the best interest of the board to give homeowners the benefit of the doubt. Not only can it improve neighborhood morale, it also saves the HOA from legal fees should it choose to pursue the matter.

What Are HOA Coupon Books?

Payment coupon books are a set of preprinted payment stubs that homeowners can fill out and mail to their HOA to pay their fees when due. Many HOAs utilize coupon books to remind homeowners to pay HOA dues, be it on a monthly or quarterly basis. HOAs are one of the few institutions in the United States that still rely on coupon books, and some states have begun to phase them out.

Additionally, coupon books are a good way for HOAs to earn revenue, as extra space can be used to advertise local businesses. For example, the HOA may sell a page to a local landscaping company that advertises their services to an entire community.

What Is the Best Way to Make HOA Payments?

Remembering to mail in your HOA dues is a pain point for countless homeowners. The best method to make HOA payments is with an online payment portal for homeowners, which can be achieved through resident portals like Hoampage.com. For homeowners, this is an easier, more expedient solution. For board members, this can make a big difference in ensuring payments come in on time.

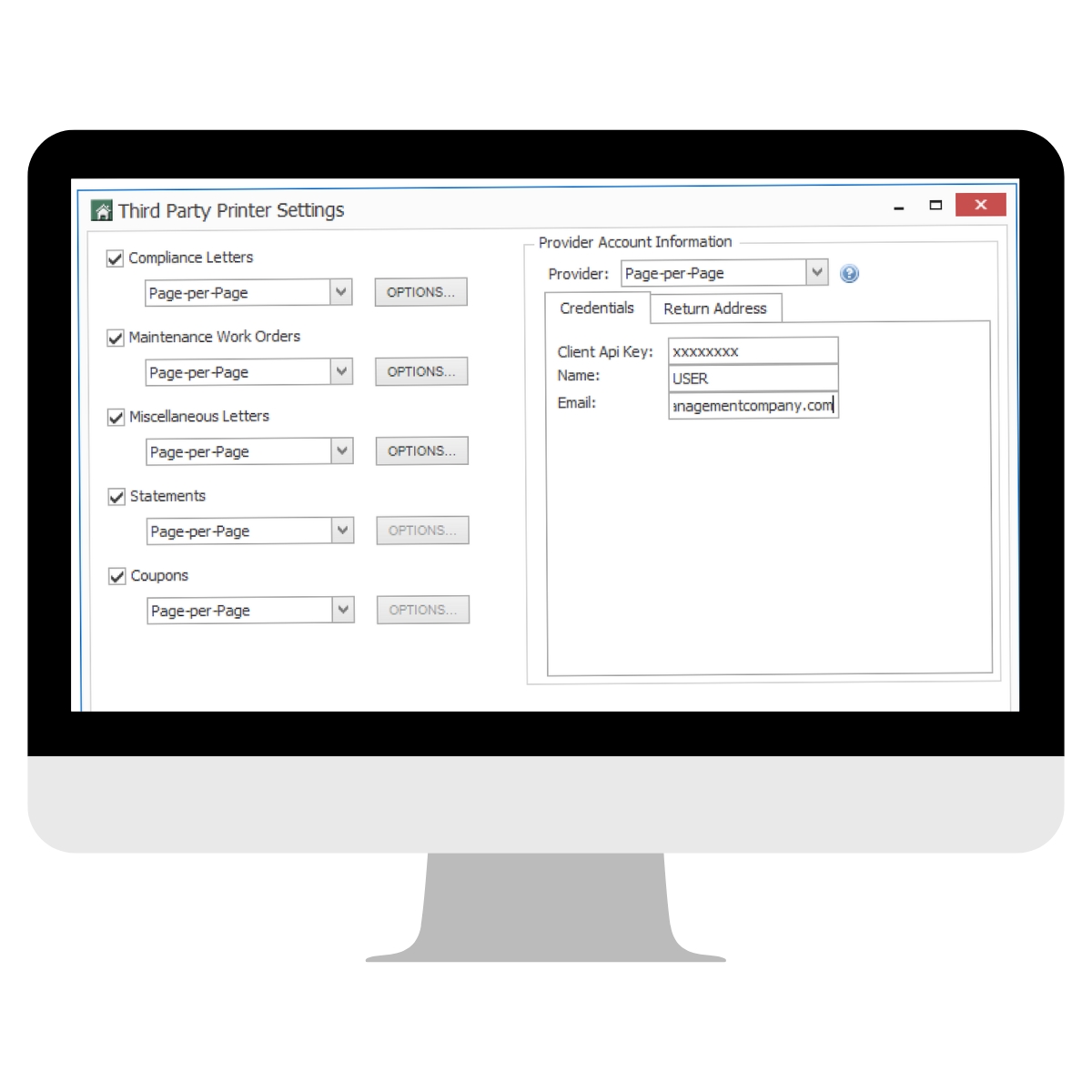

Page Per Page offers a a full-service resident portal, that gives homeowners the ability to complete all of their HOA payments securely online, among a number of other useful features. By offering multiple methods of payments, an HOA board can appeal to both younger homeowners and those who prefer traditional, physical forms of payment.

If your HOA does not currently have a payment portal, immediately petition them to create one using Hoampage via Page Per Page. The best way to do this is attend your next board meeting ready to discuss Hoampage and why you’d like to have a payment portal.