Running a homeowner’s association (HOA) involves a wide range of duties. Among these, arguably the most difficult and most important, is handling finances accurately. It is vital to keep track of all spending, savings, and contributions throughout the year to keep your HOA running smoothly.

Here’s what you need to do to manage your HOA accounting with maximum efficiency and effectiveness:

Choose the Best Basis of Accounting

Your homeowner’s association will be required to produce interim financial statements throughout the year including; balance sheets, income and expense statements. They can be prepared using one of three methods: accrual basis, cash basis, and modified accrual basis.

Here we’ll break down each of the three methods to help you choose which is best for your HOA’s unique needs.

Accrual Basis

The accrual basis of accounting records revenue when it is earned and expenses when they are incurred. This means that all financial activities are recorded in detail as soon as they happen, even if any money has not yet been exchanged.

The accrual basis is helpful because, as a HOA, you will be carrying out financial exchanges and transactions throughout the whole year. The biggest example of this is that your members will be required to pay annual dues and HOA assessments. With the accrual basis of accounting, you can document who has not paid and communicate with these people as soon as possible. For this reason, many homeowners’ associations find that the accrual basis works best for them.

Cash Basis

One the other hand, the cash basis method records financial activity only when money exchanges hands. This includes both expenses and revenue. Generally, this makes it more difficult to keep track of which bills need to be paid and which members must be contacted. The cash basis can lead to a loss of revenue as it only tracks actual cash-based transactions.

Modified Accrual Basis

Finally, the modified accrual basis combines the two methods above. Expenses are recorded when paid, but revenues are recorded when earned. The resulting financial statements let you check up on what members owe, but are generally shorter and less detailed than those provided by the accrual method.

If you are unsure of which basis of accounting to choose, accrual is typically recommended. This will provide you with the most thorough and complete records in every situation.

Complete Key Financial Reports

Another element of maintaining accurate, detailed financial records is completing key reports regularly and on time. HOA accounting reports which are necessary for a HOA or community association Board of Directors to fill out include:

Budget Variance Report and Income Statement

This report is filled out monthly. It compares the proposed budget for the month with the actual amount spent and received by the HOA. It typically also provides a snapshot of how well the HOA is adhering to its allotted annual budget. This document helps HOAs handle spending problems if their expenses begin to creep over pre-set limits.

Balance Sheet

This document should be filled out at least quarterly, if not monthly. It is generally the most thorough and detailed financial document that the HOA creates. It includes all assets – such as membership fees, fundraising results, and insurance – as well as all liabilities – such as debt or unpaid dues.

The balance sheet compares how much the organization is spending and receiving to how much is in its bank account. The totals on this sheet should always balance. If they do not, this is a potential sign of inaccurate reporting or financial dishonesty.

Check Register

This is an ongoing document which records all checks written by the HOA. It should be updated whenever a check is issued. Information gathered should include the date the check was written, the recipient, the amount of money, the check number, and the reason for this check being issued.

Bank Reconciliation Report

This report compares the HOA account’s bank statements with its own accounting records. How often it is issued depends on the bank you choose. It is used to identify potential problems such as checks bouncing due to insufficient money in a checking account or overdraft fees caused by too-frequent withdrawals.

Repayments and Credits Record

If your HOA takes out a loan for any reason, you must begin keeping one of these records. It will keep track of how much you still have to repay and help avoid your HOA sinking into debt or falling behind on payments. Typically, this report also covers tax deductions and credits which will assist you in filling out annual tax paperwork for the association.

Follow Best Practices

In addition to filling out all reports on time, follow these best practices to keep your HOA members budget-conscious and honest.

Segregate Duties

One best practice that HOAs can put into place when managing finances is to segregate the duties rather than having one single person take care of it all. For example, it’s generally recommended to have a different person or group managing Accounts Payable (expenses), Accounts Receivable (income) and the General Ledger (accurate transaction records).

This helps to keep all departments honest and accountable, as well as avoiding overloading a single individual. These teams will be able to check each other’s work and prevent anyone from falling behind on their reporting duties.

Hold an Annual Audit

It can be difficult to determine a budget without knowing where your HOA stands financially. That’s why it’s helpful to take a comprehensive look at your HOA’s finances each year. Ask yourself:

- How well did we stick to our budget?

- Where did we struggle?

- Do we have any unpaid debts, and what does our repayment timeline look like?

- How much money is in our bank account?

Many HOAs will hire a professional such as an accountant to assist with the completion of their audit. The results of this audit will be used to make a financial plan for the upcoming year, including setting a new budget and highlighting areas to improve.

Constantly Communicate

Open discussions about finances should be held regularly among the members of your HOA – not just the Board of Directors, but all homeowners living in the neighborhood as well. Be transparent about all financial transactions. Report both struggles and successes so all members can both celebrate good news and brainstorm problem solutions together.

In addition, keep lines of communication open with all vendors your HOA regularly works with. Check-in to make sure that prices aren’t being raised and payments are being made on time. Constantly be on the lookout for good deals in your area, even if that means switching vendors and starting a relationship with someone new.

How Page Per Page Can Help

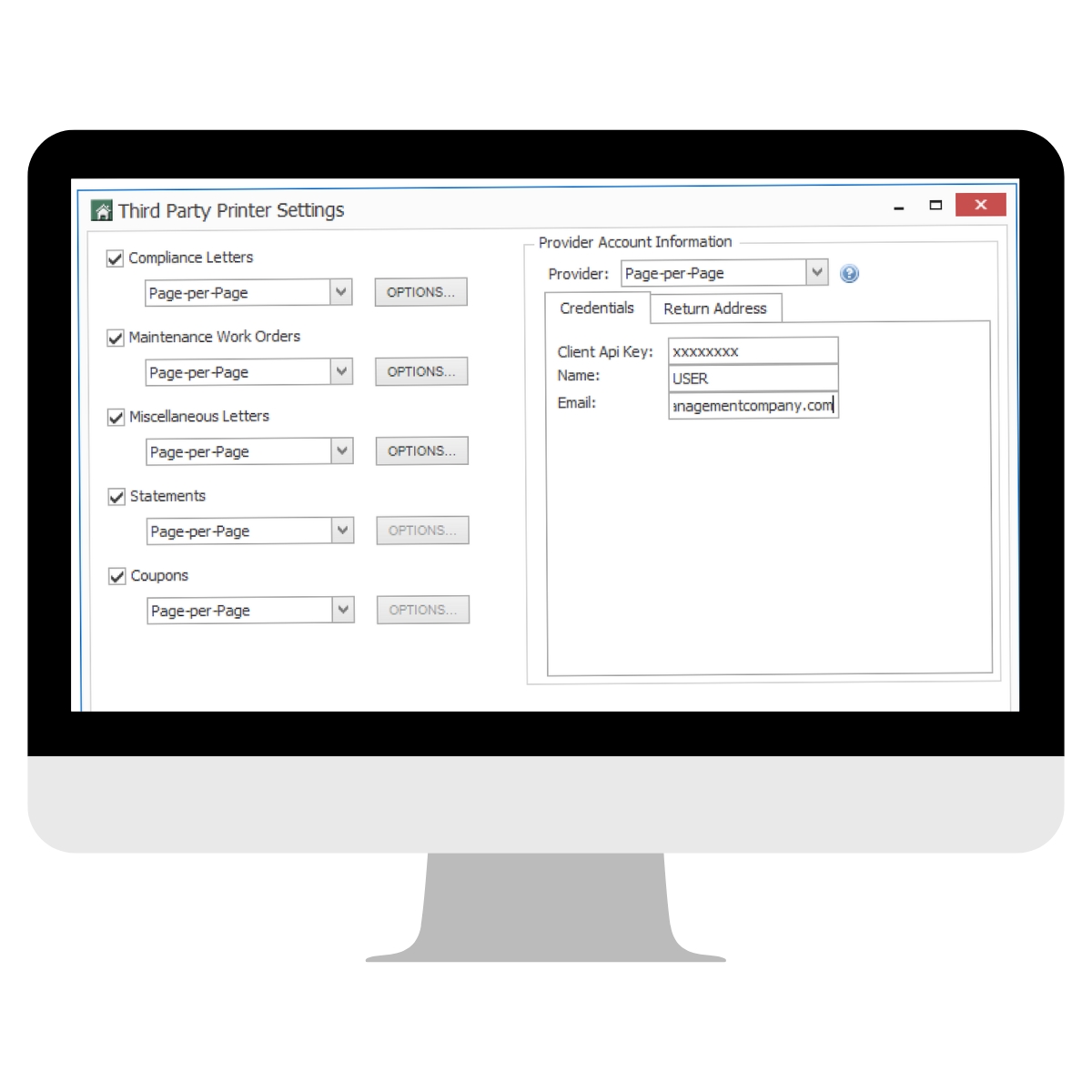

A part of mastering HOA accounting and putting together your important financial documents is effectively managing members’ fees and assessments. But, first they have to know about them! Which is where Page Per Page can lend a hand.

With decades of experience working with community associations, Page Per Page can print and mail any of your important HOA documents, including financial notifications, notices, newsletters, ballots, and more to your members.

Not only can they take care of your printing and mailing needs, but they also can help you to craft one of the best HOA websites with their HOAMPAGE website solution as well! Administrators can manage all of their websites in a single location while giving their homeowners a place to stay up-to-date on their community.

Let Page Per Page ease some of your HOA responsibilities!