Managing a community association is no easy task. Regardless of whether you’re a full-time, dedicated manager or have been newly elected as this year’s treasurer, one important piece of being a part of a HOA is handling the finances efficiently.

Every month, you’re receiving dues from homeowners (and sometimes hoa assessments as well), which can be a lot to keep track of and organized efficiently. This is where partnering with a dedicated HOA bank comes in handy. They provide services specifically for homeowner’s associations that will make your life easier. Since there are quite a few out there, you’ll want to find one that offers the best services fit for your needs.

With that being said, here are 3 important HOA bank services to look out for in an association bank:

1. Dedicated HOA Personnel

As a member of a homeowner’s association, you understand the importance of experience and knowledge in the field, especially when it comes to managing all the finances. It’s equally important for your banker to possess the same understanding of homeowner’s associations. This is why using a bank with dedicated HOA personnel or Account Managers is a huge plus.

Someone that has experience dealing with HOAs has the ability to answer any of your specific banking questions accurately and can act as an advisor to be sure all your banking needs are met. Working with standard bank staff, you may not have such a specialized experience. Having the support of exclusive HOA banking personnel can ensure that your finances are in the right hands.

2. Simple Payment Options

Collecting dues is one of the most important responsibilities of a HOA. It’s how the community is maintained, be it snow removal, playground upkeep or landscaping. So having an easy way for homeowners to pay their dues is crucial. You’ll want to partner with a bank that offers simple payment options for your homeowners, such as:

- A secure payment platform built directly into the association’s website

- Auto pay or automatic debit/ACH option

- The ability to validate a homeowner’s check payment online

- Remote deposit

If your homeowners don’t have an easy way to pay their dues, they may be confused or frustrated by the process and that could result in delayed payments.

3. Custom Loans with Good Rates

In the event of a natural disaster or unexpected damage to the common areas, there may be last-minute expenses that may not be covered by monthly dues. This is where custom bank loans can help out. The good news is, HOAs follow different rules when it comes to applying and qualifying for loans. A bank that has experience dealing with HOAs will be able to offer practical alternatives that benefit both the homeowner and the association like:

- Using HOA dues as collateral

- Differentiated interest rates during and after remodeling

- Custom assessments to determine if (and how much) to increase monthly payments

All the Services You Need

Without a doubt, banks that offer specialized HOA services can be a great help in handling the financial responsibilities that come with being a part of a homeowner’s association. Finding the right bank with these services can ensure that money collection and management is as seamless as possible.

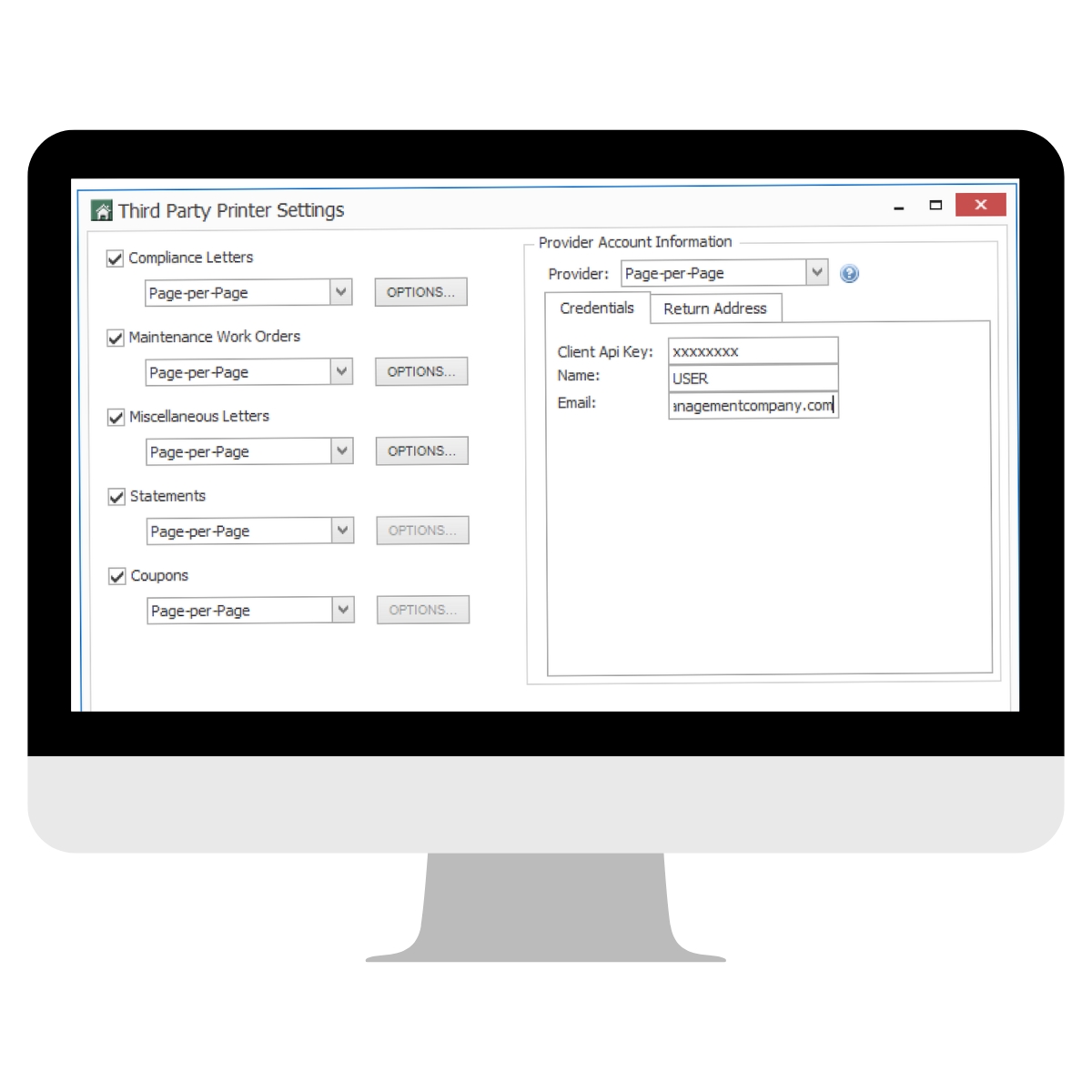

Additionally, companies like Page Per Page can provide HOA services in other areas of need. Page Per Page specializes in printing and mailing solutions specifically for homeowner’s associations. You can easily send anything from financial statements to voter ballots with a simple online order. Pair a bank with dedicated HOA services with Page Per Page for all your HOA mailing needs to make your community association responsibilities much more manageable.