How Arizona questioned the future of one of the oldest forms of HOA payment

Remember when The Jetsons bore no resemblance to reality? When nothing was digitized and paper copies reigned? Finances were carried out with hard cash, paper checks, and enveloped bills. Big-ticket expenses like homes and cars came with payment coupon books, a tool to help buyers remember to make on-time payments.

When Phil Hoffman, founder and CEO of Page Per Page, purchased his first home in 1981, he recalls the 360-page coupon book he was provided. Thirty years worth of payments, ready to be signed, stamped and delivered.

“They were the most economical way for a lender to help a buyer pay their bills.” Phil explains.

The concept of coupon books is entirely foreign to the millennial set, who spent the greater part of adulthood using set-it-and-forget-it online bill pay. As that became the standard, payment coupon books became a distant memory – disappearing from the financial landscape.

Everywhere, that is, but the HOA industry.

Jump ahead to 2020, and you have thousands of the HOAs across the country issuing coupon books to millions of homeowners to collect association dues. It begs the question: how did a payment system of the past sneak past the bullish drive to modernize all things financial?

That question might finally be answered, as the future of coupon books’ in the HOA industry has become uncertain, and it all began with an Arizona senator and a missed payment.

David Farnsworth (R-Mesa) lived in a community that still used a coupon book system. Because he did not receive financial statements, he was never privy to a violation he’d made and its compounding fines. As a result, the senator personally took it upon himself to dust off some antiquated legislation. Just like that, a payment system that had quietly slipped through the cracks of modernity was put to bed – in one state.

As news spread of the changes taking place in Arizona, management executives across the country began to wonder if the same events would come to pass in their own states, and force them to retire coupon books.

But why would that be a less than ideal scenario for the community management industry? For the same reason that payment coupon books lingered as long as they did. No one knows for a fact, but there are plenty of theories percolating.

Coupon books as a payment system were written into the CC&Rs that govern how communities are run. To change them would have meant campaigning, galvanizing the votes of homeowners, then hiring lawyers to rewrite the CC&Rs. Board members couldn’t justify such backbreaking labor to replace a system that worked so well, and cost so little. At around $3 to print and mail, replacing coupon books with monthly periodic statements would triple or even quadruple the cost incurred.

The final working hypothesis as to why coupon books continue to stick around: 12-slip coupon books make the size of payments more manageable. HOAs were often concerned that billing a homeowner less frequently – let’s say, with quarterly or annual financial statements – would make payments too large and financially burdensome. If an association asks $100 in monthly dues, then an annual bill would demand $1200 in one payment. Even quarterly, a $400 bill could be a tight squeeze for many homeowners.

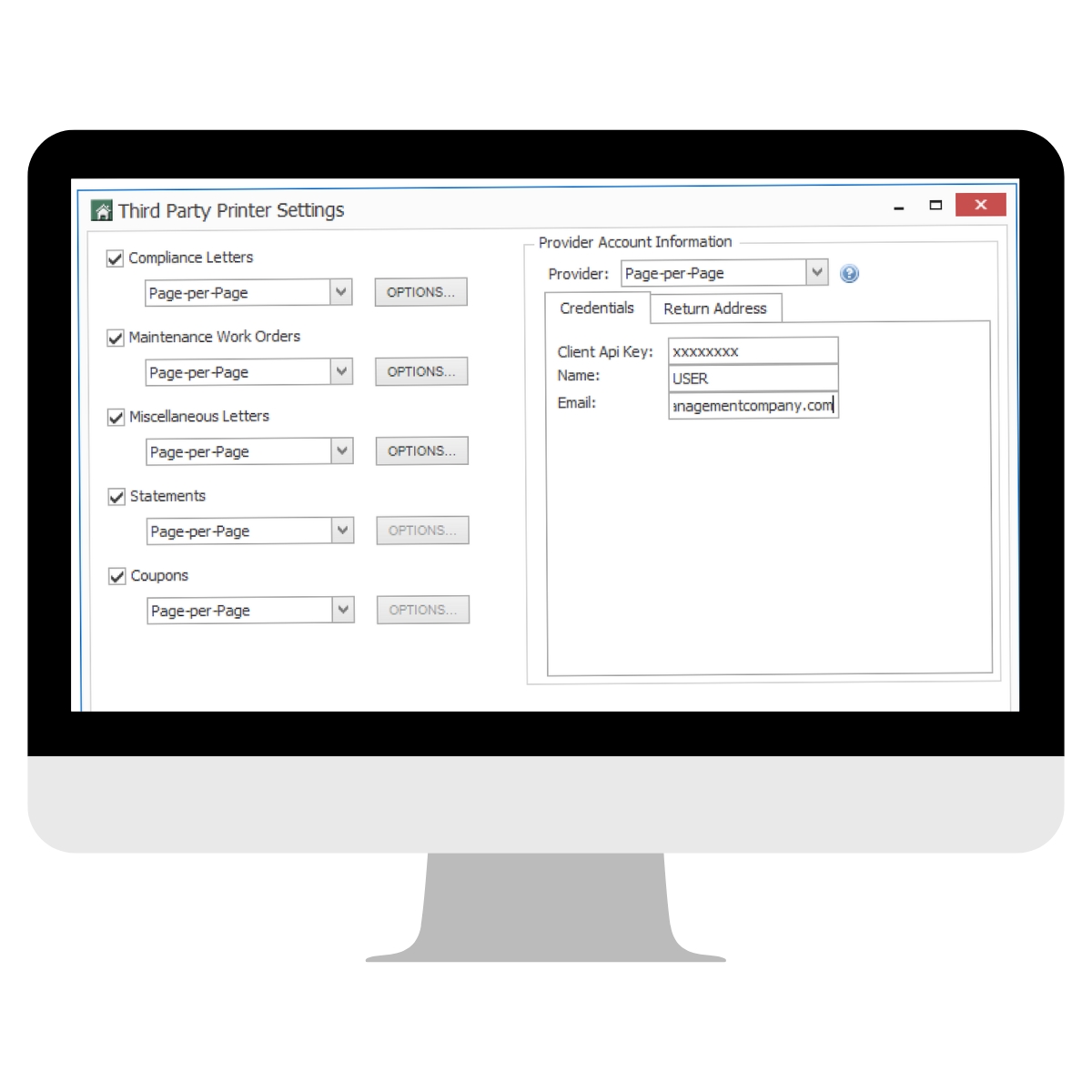

Because a shift to monthly statements would be so much more expensive, many management companies and HOAs are eyeballing a potential move toward e-statements, provided they can get their homeowners to opt in.

HOAs aren’t the only ones considering the switch. We’ve all seen companies, from our electrical providers to banks, asking us to opt in to paperless billing. Phil suspects that trailblazers in the community management industry may begin charging homeowners who still insist on paper statements, to incentivize the shift.

How management professionals perceive the change depends on their personal disposition. As Phil notes, if we look at the demographics of homeownership, we’re seeing a huge downward shift in their age bracket. These under-40 homeowners will drive the eventual, inevitable shift to digital.

Six to seven months into this transition, other states are watching the developments in Arizona closely. After management companies and HOAs absorbed the fears of extra costs, many saw it as an opportunity to connect with homeowners with increased frequency. Beyond board elections, some HOAs have minimal communication with homeowners. Forward-thinking associations have begun to see 12 statements per year as an opportunity to connect with homeowners in a more positive way. A billing statement attached to a community newsletter, or stapled to a thank you note for having such an immaculate lawn – may become the norm. Communication between HOAs and homeowners can sometimes be infrequent or by and large negative. But for management trailblazers, the new coupon book legislation may be changing that.